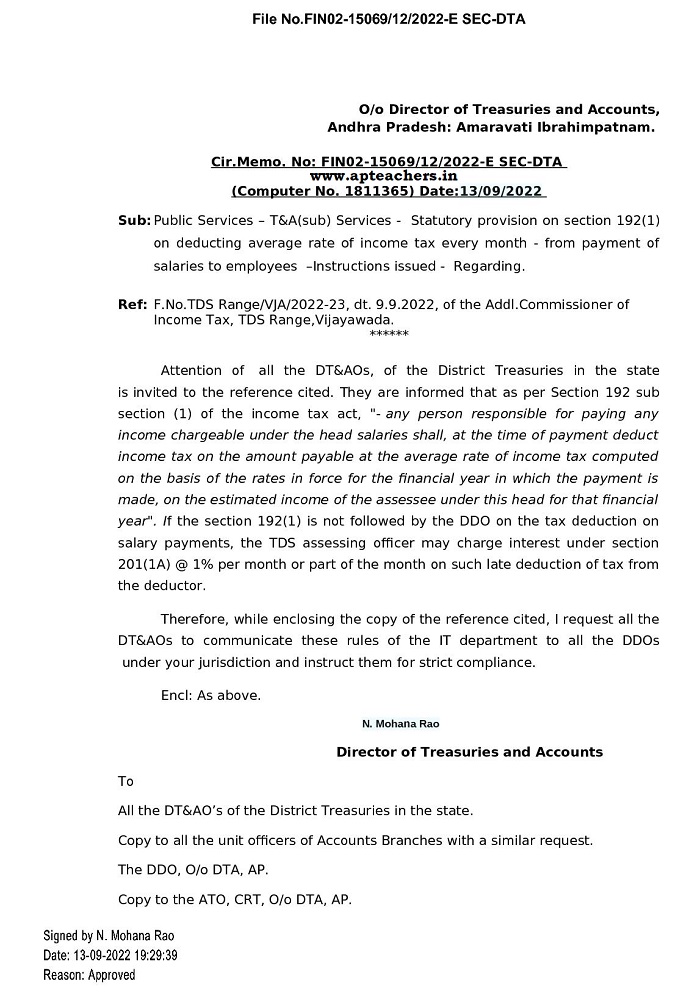

Deduct Monthly TDS on Salaries from Employees DTA Cir Memo FIN02-15069/12/2022-E SEC-DTA Cir. Memo. No: FIN02-15069/12/2022-E SEC-DTA (Computer No. 1811365) Date: 13/09/2022

Ref: F.No.TDS Range/VJA/2022-23, dt. 9.9.2022, of the Addl. Commissioner of Income Tax, TDS Range, Vijayawada.

Attention of all the DT&AOs, of the District Treasuries in the state is invited to the reference cited. They are informed that as per Section 192 sub section (1) of the income tax act, "- any person responsible for paying any income chargeable under the head salaries shall, at the time of payment deduct income tax on the amount payable at the average rate of income tax computed on the basis of the rates in force for the financial year in which the payment is made, on the estimated income of the assessee under this head for that financial year". If the section 192(1) is not followed by the DDO on the tax deduction on salary payments, the TDS assessing officer may charge interest under section 201(1A) @ 1% per month or part of the month on such late deduction of tax from the deductor.

Therefore, while enclosing the copy of the reference cited, I request all the DT&AOs to communicate these rules of the IT department to all the DDOs under your jurisdiction and instruct them for strict compliance.

Deduct Monthly TDS on Salaries from Employees DTA Cir Memo FIN02-15069/12/2022-E SEC-DTA

Sub: Public Services – T&A(sub) Services - Statutory provision on section 192(1) on deducting average rate of income tax every month - from payment of salaries to employees –Instructions issued - Regarding.Ref: F.No.TDS Range/VJA/2022-23, dt. 9.9.2022, of the Addl. Commissioner of Income Tax, TDS Range, Vijayawada.

Attention of all the DT&AOs, of the District Treasuries in the state is invited to the reference cited. They are informed that as per Section 192 sub section (1) of the income tax act, "- any person responsible for paying any income chargeable under the head salaries shall, at the time of payment deduct income tax on the amount payable at the average rate of income tax computed on the basis of the rates in force for the financial year in which the payment is made, on the estimated income of the assessee under this head for that financial year". If the section 192(1) is not followed by the DDO on the tax deduction on salary payments, the TDS assessing officer may charge interest under section 201(1A) @ 1% per month or part of the month on such late deduction of tax from the deductor.

Therefore, while enclosing the copy of the reference cited, I request all the DT&AOs to communicate these rules of the IT department to all the DDOs under your jurisdiction and instruct them for strict compliance.